Our recommendation for most people is Shopify because it has everything you need to start accepting ecommerce payments immediately. Try Shopify free for three days, no credit card required.

Every ecommerce site must be able to accept payments from customers online. After all, your entire business model revolves around getting paid.

After researching and reviewing dozens of payment gateways, we narrowed down the best options on the market today. Whether you have an existing ecommerce business or you’re starting a new one from scratch, this guide will help you find the right payment method for you.

The Top 11 Payment Methods for Ecommerce Sites

Our favorite ecommerce payment methods are:

- Shopify – Best overall value

- Square – Best for restaurants, retail, and services

- Payment Depot – Best for high-volume sales

- Stax — Best for small businesses

- Helcim — Best for lowering fees

- Payoneer — Best for international fund transfers

- 2Checkout — Best for international ecommerce

- Stripe — Most developer-friendly

- PayCafe — Best fraud prevention

- PayPal — Best for creating your first online store

- PaymentCloud — Best for high transaction volume

If you haven’t yet started your online store, Shopify is the way to go. But if you’re already selling online, Square and Payment Depot won’t steer you wrong.

Shopify — Best Overall Value

Shopify provides everything people need to start selling goods and services online. It’s a payment processor, online store builder, and ecommerce marketing solution all in one.

Because everything is included and works so well together, we highly recommend Shopify for people launching new stores. That said, people on a different ecommerce platform may be convinced to switch once they experience the convenience of Shopify.

Shopify Payments is activated once you sign up for an account. There’s no wait time to start accepting major credit cards and other digital payments.

Every transaction is tracked and displayed automatically. There’s minimal busy work necessary to stay on top of your sales, payments, and monthly numbers.

Shopify is convenient for your customers, too. Once you have an account, you will be able to accept a wide range of popular ecommerce payment methods, including:

- Visa

- Mastercard

- American Express

- Discover

- PayPal

- Google Pay

- Apple Pay

- Facebook Pay

Shopify Payments comes as part of every Shopify plan. There are integrations with dozens of other ecommerce payment methods, but those have transaction fees. There is no transaction fee when you use Shopify Payments.

There are a variety of ways to get set up with Shopify.

Shopify Starter is $5 per month, and lets you create shoppable links. Sell directly on social media, text, and email, and Shopify handles the rest.

Basic Shopify is $39 per month and includes everything we’ve reviewed so far. Build a store, ship products, sell services, and start making money. Upgrading your Shopify plan will bring your credit card processing fees down.

You do get a discount on Shopify’s website plans if you switch to annual billing, with the Basic plan coming down to $29 per month.

It makes a good deal even better. Learn more about Shopify and take a free trial, no credit card required.

Square — Best for Restaurants, Retail, and Services

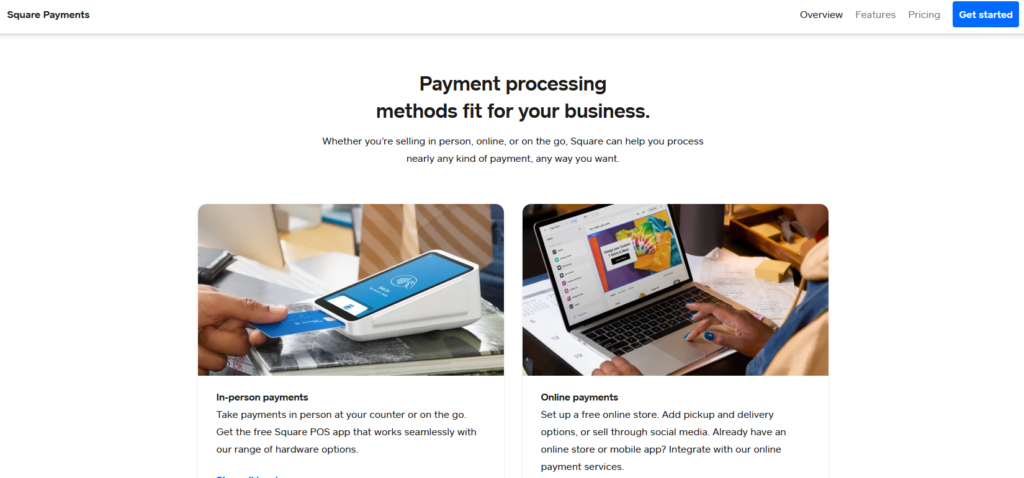

Square is a great choice for those of you who have physical locations and plan to start selling online.

Why? It’s simple: they’re known for their stellar POS system that seamlessly integrates with their payment method solutions. That makes them a great option if you’re planning to open retail locations in addition to your ecommerce shop.

Don’t have a shop yet? Square offers a fantastic ecommerce website builder too. They don’t skimp on the builder either, offering you tons of great-looking drag-and-drop themes that allow you to create the ecommerce store of your dreams—no coding knowledge needed.

Square is priced competitively compared to the other methods on our list.

There is no monthly fee for adding the Square payment gateway to your website. They charge you 2.9% + $0.30 per transaction, just like Stripe and PayPal.

Integrating Square into your ecommerce platform is easy. Some of their ecommerce partners include:

- Wix

- WooCommerce

- GoCentral Online Store

- Ecwid

- 3DCart

- OpenCart

- Magento

- Miva

- Drupal Commerce

- X-Cart

- Zen Cart

- ShipStation

- Mercato

- Unbound Commerce

- WordPress

- nopCommerce

- WP EasyCart

- Sociavore

So if you’re currently using one of these platforms for your ecommerce shop, adding Square will be a breeze. Click here to learn more at Square.

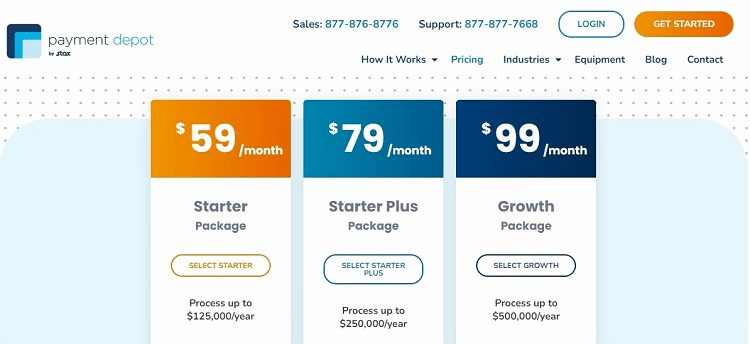

Payment Depot — Best for High-Volume Sales

Payment Depot touts itself as the “Costco of credit card processing” for its membership fee-based pricing model as well as its completely transparent pricing.

Payment Depot goes with a single membership fee, rather than charging you per transaction. You can purchase a membership package based on the financial amount of the transactions you do annually.

This is a different business model than many payment processing services, which may charge you a percentage of your transaction amounts. As long as you are doing a significant amount in financial transactions per year, Payment Depot should save you quite a bit on fees.

Payment Depot’s updated plans and prices include:

- Starter — $59 per month: Process up to $125,000 per year

- Starter Plus — $79 per month: Process up to $250,000 per year

- Growth — $99 per month: Process up to $500,000 per year

Transaction fees are 0.00% + $0.08 on swiped/chip transactions and 0.00% + $0.18 on online transactions.

Should you need to process more than $500,000 in transactions annually, you can request a custom price quote from the company.

However, if you’re a smaller business, you might end up paying a bit more for the monthly membership fee. That’s why we really don’t recommend this brand if you make less than $25,000 per month.

If you go with an annual membership, Payment Depot offers a 90-day money-back guarantee. That means you can cancel within three-ish months and send your equipment back, and you’ll get a complete refund.

Visit Payment Depot to get great rates for your heavy transaction processing. Note that this program is exclusively for companies based in the US.

Stax — Best for Small Businesses

Stax is ideal for any small business. Not only does it accept all payment types and integrate with most terminals and point-of-sale (POS) systems, but it is also a subscription-based pricing model with a flat monthly fee.

This means Stax can save you money per transaction, especially once you factor in the 0% markup on interchange fees. More sales do not mean higher fees from Stax.

For your ecommerce store, Stax has flexible options so you can integrate it with the shopping cart plugin or function you already use or use one of Stax’s pre-built templates (or design your own) to create your own custom shopping card quickly with no coding skills required.

Stax’s one-click shopping cart integrates with all of the top payment gateways, such as BigCommerce, Magento, WooCommerce, Salesforce, and more.

Stax’s ecommerce tools include:

- Heatmaps to keep track of staff and sales trends

- Inventory tracking for online and in-person stock

- Reporting and analytics to get real-time reports on customer behavior and patterns

- Integration with QuickBooks and Google My Business

Stax’s pricing is very straightforward. It is a monthly subscription with no long-term contract and transparent fees. All three subscription tiers come with wholesale interchange pricing (0% markup), $500,000 in annual processing, a large knowledge base, and 24/7 customer support.

By having a flat-fee monthly subscription, your ecommerce business knows exactly what you’ll pay each month, and if you have a lot of transactions, you’ll pay less per transaction, making it very affordable.

Pricing starts at $99 per month, which includes ACH processing, analytics, and more. Transaction fees are 0.00% + $0.08 on swiped/chip transactions and 0.00% + $0.18 on online transactions.

It’s important to note that this program is exclusively for companies based in the US. Learn more about Stax.

Helcim — Best for Lowering Fees

Helcim is another “one-stop-shop” solution for your payment needs. From point-of-sale hardware to ecommerce payments, it has what you need to get started selling.

Where it really stands out is its unique fee structure, which includes no monthly fees.

Pricing is highly customized depending on your monthly volume of sales and the price of your average transaction. That means the more sales and/or the higher the price of the average transaction, the more you save.

You can save even more due to the fact that they have:

- $0 monthly fees

- $0 set up fees

- $0 cancellation fees

- $0 compliance fees

- $0 bank deposit fees

That’s a big difference from other payment method solutions out there, which typically charge for all of the above.

However, I wouldn’t actually recommend Helcim if you have a high volume of sales. If you’re an enterprise business that deals in a lot of monthly transactions, we recommend Payment Depot instead. They’ll offer the best overall rate if you’re a big business.

But we do recommend Helcim for mid-sized companies. You’ll get the best overall rate if you do anywhere between $25,000 and $50,000 per month.

It’s worth mentioning there’s even a platform for you to create an online store through Helcim. It’s on the Helcim site and comes with its payment processor built in. It’s also highly customizable and comes default with some great-looking themes.

If you already have an online store, Helcim has you covered. Its fully-hosted payment pages allow you to add payment options to your site without any coding knowledge. This solution can be integrated with some third-party software you might already be using such as QuickBooks, Drupal, and Magento.

There’s a deal going on right now where you can get the first three months for free. After that, it’s $20 per month. Try Helcim today!

Payoneer — Best for International Fund Transfers

An ecommerce site that is already established in global selling knows there’s still room for improvement. That could take the form of growing into untapped markets, keeping more of the money you make on international sales, or finding better ways to work with suppliers.

Payoneer knows the way to accomplish any and all of these improvements and has the software to prove it.

First, Payoneer eliminates the pain of costly wire transfers and currency conversion with an easy way to set up localized receiving accounts, so you get payments in USD, EUR, or one of several other options.

In just three easy steps, you can set up accounts, email customers info on how to pay you, and automatically have those payments sent to your Payoneer account.

It should be noted: Payoneer isn’t a merchant account provider. That means it does not give you the ability to accept payments via debit or credit cards. Instead, it sets up a local bank within the region you want to attain money for and allows for bank transfers instead. This is particularly helpful for some specific business types.

For example, global businesses lean hard on their network of suppliers and vendors. So, Payoneer makes it a cinch to pay them when you need to. By paying them directly from your Payoneer account balance, payments are sent instantly and for free. Plus, you can send in batches of up to 200 for convenience.

If you’re struggling to make headway in some global markets, you can even lean on Payoneer’s network of partners. From shipping and sourcing services to legal assistance, translation, and advertising, you can fill in the gaps by connecting with vendors based in the markets you’re trying to sell to.

Payoneer does charge low-cost fees for some transfers and there is an annual account fee, but it’s a scant $29.95/year.

You can register at Payoneer for free today.

2Checkout — Best for International Ecommerce

Your growing business can’t worry about the reliability of its payment processing. When you’re striving to make inroads into new markets or break into global business, that detail needs to already be taken care of.

That’s where 2Checkout excels. It’s a modular solution that is very scalable with no stress on your end.

With this software, you can handle global payments, subscription billing, taxes, and any other ecommerce payment needs. Start with what you need right now and when you’re ready to take the next step up, 2Checkout has a feature to help.

But, above all, this software is the perfect partner for international selling.

The distinction between this and Payoneer is that 2Checkout will actually facilitate payment processing via typical ecommerce methods such as credit card, debit card, PayPal, and more.

With any of 2Checkout’s modules, you can start selling in over 200 countries in no time. And, if you utilize their 2Monetize platform, you can rest easy knowing that they’ll handle the heavier stuff, like VAT and regulatory compliance.

Even better—you can start on any of 2Checkout’s solutions for free. You only have to pay once you start selling.

That’s a huge boost for those of you who want to really test drive the software before committing.

Once you do start selling, you pay a fraction of each sale plus a small fee. On 2Checkout’s base-level plan, 2Sell, that runs you 3.5% + $0.35 on each transaction.

Get started with 2Checkout for free today.

Stripe — Most Developer-Friendly

Stripe is one of the top payment methods on the market today because it’s so versatile.

It’s a great choice for ecommerce shops, subscription services, or on-demand marketplaces. For those of you who operate a business with multiple processes and services, this is definitely something that you should take into consideration.

Where Stripe really shines though is how developer-friendly it is. It offers great tools that let any team customize their payment methods.

From the easy-to-use API, the library for coding languages, and the comprehensive integrations, a developer can get everything they need to out of Stripe.

Another top feature of Stripe is the ability for you to set up recurring payments from your customers.

It supports payments online, as well as in-person. So if you currently have a brick-and-mortar store, you can add a Stripe POS system in addition to the gateway on your ecommerce site. This way you can remain consistent across both marketplaces.

Studies show that brands using Stripe have increased revenue by 6.7% after implementing the payment gateway. With Stripe, you’ll have 81% fewer outages and 24% lower operating costs compared to competing payment methods.

Another reason why I love Stripe is that you’ll have the option to customize your checkout process with the Stripe UI toolkit.

Stripe accepts all major credit cards and debit cards from all countries, including:

- Visa

- Mastercard

- American Express

- Discover

- JCB (Japan)

- UnionPay (China)

You can also integrate some alternative payment options into your Stripe payment gateway. Some of these we’ll discuss in greater detail as we continue through this guide.

- ACH transfers

- American Express Checkout

- Masterpass

- Visa Checkout

- Apple Pay

- Google Pay

- Microsoft Pay

It’s great for those of you who are using your ecommerce platform to drive sales from mobile users.

Stripe’s standard pricing is simple. As a merchant, it will cost you 2.9% + $0.30 for every card charge. There will be an additional 1% charge for international cards.

For ACH transfers, your cost is 0.8% of the transaction with a $5 maximum fee.

Additionally, Stripe offers customized pricing options for those of you who have a unique business model or have large volume payments. You’ll get discounts for volume and multi-product rates, as well as some country-specific rates if you’re targeting an international market.

Stripe has exceptional tech support and customer service. You can reach representatives 24/7 via phone, live chat, or email. Overall, it’s definitely one of the top payment methods for you to use on your ecommerce site.

PayCafe — Best Fraud Prevention

PayCafe offers some of the best fraud and chargeback protections we’ve seen out there.

Seriously, the only other one we consider a contender to their level of protection is PaymentCloud.

That’s because it offers an automated, machine-learning algorithm that scans each transaction for fraud. Once it detects it, you’ll be notified and the troublesome transaction will be blocked. Of course, if there’s a mistake you’ll be able to undo it and put the transaction through.

PayCafe also has tools in place to handle credit card disputes. From an early warning dispute alert system to highly-detailed records of each transaction, it’ll arm you with the tools you need to tackle pesky chargebacks and win.

Some of their other features and benefits include:

- Recurring bills. PayCafe automatically bills your customers daily, weekly, monthly, or annually depending on how you set it up.

- International card and currency. This allows you to accept payments for all major credit cards in every country across 135+ currencies.

- Flexible payment methods. Accept payments from places like PayPal, direct deposits, and even cryptocurrencies.

- In-depth reporting. Dive into the crunchy analytics of your business. That way, you can improve your numbers over time.

On top of all that they even give you 24/7 customer support every single day of the year. That’s a must-have when it comes to ecommerce payment processing.

You never want to be in a position where something breaks and you can’t immediately address it. Learn more at PayCafe.

PayPal — Best for Creating Your First Online Store

PayPal is a name that I’m sure most of you are already familiar with. The company has a reputation that speaks for itself when it comes to ease of use, reliability, and security.

Hundreds of millions of people trust PayPal and use it every day for their business.

This is why we highly recommend PayPal if you’re just starting out. Not only does everyone already use PayPal, but it’s also very easy to add and integrate into practically any online store.

For those of you who don’t have a well-established name brand yet, the PayPal button can help put your customers at ease. They know that PayPal has their back for security.

Plus, people might have a PayPal balance that they want to use for spending, as opposed to charging a credit card or debit card.

PayPal is the most commonly used digital wallet in the world. With PayPal for ecommerce, you can accept:

- Credit cards

- Debit cards

- PayPal

- Venmo

- PayPal Credit

PayPal offers many different payment options that you can offer to your customers, which enhances its popularity. You can deliver the precise way you want to let your customers pay. Options include:

- Online checkout on the website

- Online checkout through an app

- Pay later in installments

- Charge recurring subscription payments

- Online checkout through social media

- Accept payments in person

PayPal also has an option that will allow you to generate estimates when bidding on a job and invoices for your completed jobs, saving you time.

Standard credit card and debit card payments carry a 2.99% fee rate (based on the transaction amount) plus a $0.49 fixed fee in the United States. For other transaction options, fee rates range from 1.9% to 3.49%. Most of them have small fixed fees as well.

International sales’ fee rates typically will be 4.49%, plus a fixed fee, depending on the country where the purchase originated.

PaymentCloud — Best for high transaction volume

PaymentCloud is another one of our recommendations. Not only can it provide you with an easy way for customers to purchase your products and services, but it also offers top-notch security features, including fraud and chargeback protection.

What really sets it apart, though, is its clientele. While most merchant solutions restrict who they work with to “low-risk” businesses, PaymentCloud is one of the rare ones who have systems in place to work with higher-risk businesses.

These are the businesses that typically deal in matters with sticky compliance issues—or might get more chargebacks than your average ecommerce sites. A few industries they won’t shy away from (though others might) are:

- Cannabis

- Guns and ammunition

- Adult products

- Alcohol

- Bail bonds

- Vape products

- Tobacco products

- Credit repair

- Debt consolidation

Couple that with its chargeback and fraud protection feature, and you’ve got a match made in heaven if you’re a higher-risk business.

It’s also an all-in-one ecommerce merchant. Instead of needing to Frankenstein together different shopping cart solutions and find a separate way to take mail and phone orders, you can take care of them in one fell swoop.

The provider’s payment gateway works well with just about any ecommerce platform you could use, including:

- Big Commerce

- WooCommerce

- Magento

- Shopify

- Shift4Shop

- Ecwid

- OpenCart

- Volusion

So, you’ll never have to worry about its integrative capability.

PaymentCloud allows you to accept debit and credit cards, as well as e-checks. The payment gateway lets you accept payments anytime, set up invoices and subscriptions, and ensure safe transactions at both ends. All payment information goes through five layers of security.

You can also set up a shopping cart on your ecommerce store through PaymentCloud or integrate it with one that you like using already. You get the same ease of use (on both ends) and security from PaymentCloud’s shopping cart as you do its payment gateway and processing service.

There are no setup or cancellation fees and processing rates and PaymentCloud’s fees are competitive—its processing fee is identical to Square’s and the payment gateway fee tends to run at about $15-$20 per month.

Get a secure payment processing platform and a shopping cart together by going with PaymentCloud. Connect with them to apply for free—and, if you’re shopping for a replacement for your current ecommerce payment platform, PaymentCloud will provide cost comparisons for free.

How to Find the Best Payment Method for Your Ecommerce Website

Not every ecommerce website is the same—and your payment methods shouldn’t be either. But narrowing down the perfect option can be tough with so many options to choose from.

Below are the exact criteria we used to determine our list. Use it over the course of your research to help find the perfect payment method for your ecommerce website.

Fair (But Affordable) Processing Fees

Every payment method charges fees for its services. They typically come as:

- Monthly fees — Flat prices you have to pay each month for their services. Payment Depot, for example, utilizes this method.

- Processing fees — Fees you’ll have to pay with each transaction. These are occasionally variable (i.e., interchange processing rates), or they’ll offer a fixed rate, as with ProMerchant.

Many merchant services typically charge both a monthly fee and a processing fee for their services. But the ultimate price varies depending on the service.

For example, Shopify, Square, Stripe, PayPal, and Payment Cloud charge 2.9% + $0.30 per transaction. That’s a pretty typical standard for the industry.

Other solutions have a unique way of charging you for their services. For example, Helcim customizes the price for you depending on your monthly sales and the average price of your transactions. The more you sell each month and the higher your average transaction is, the less your rate is going to be.

Helcim is great because there are no fees outside of the transaction fees. That means no monthly, setup, or cancellation fees.

When researching, be sure to take a look at how the payment method you’re considering charges you—and by how much.

In the end, it’s a bit of a balance between monthly fees and processing fees. Higher monthly fees typically mean lower processing fees (and vice versa). If you don’t have a ton of transactions each month, it might make more sense to pay a lower monthly fee and go with the high processing fees.

Payment Methods That Meet Your Customers Where They Live

Selling globally can be tricky for ecommerce businesses—especially if you’re just starting out. You have to worry about exchange rates, and you also have to consider what entails typical payment methods in that country.

For example, Alipay is one of the most popular payment methods in China. PayPal probably takes the crown in America.

Not every payment method gives you the option of completing purchases internationally.

Payoneer is an excellent payment method if your business plans to sell overseas. They’ll help you set up localized receiving accounts so you can receive payments in USD, EUR, GBP, CNH, JPY, AUD, CAD, SGD, and MXN.

2Checkout is another method you should consider if you want to handle global payments. You can get set up to sell in more than 200 countries in just a few minutes.

That means you’ll be able to literally open up your store to the entire world—tapping into a global market of potential customers. You can also convert your funds into different types of currencies, so you’re not restricted to just receiving money in USD.

If you plan on selling internationally, definitely look into how the payment method you’re considering handles non-USD currencies, if they can at all.

Checkout So Simple Customers Never Abandon Their Cart

You need to make sure the user experience is effortless for your customers. For ecommerce stores, this process is arguably most important when it comes to the payment method.

A single hiccup or irritating moment while they’re at checkout could result in a higher cart abandonment rate for you—causing a sizable hit to your bottom line.

You can prevent this easily with the right payment solution. With PaymentCloud, for example, your customers can simply enter in their purchase information and be on their way in less than a minute. The same goes for Square, which offers a very seamless ecommerce experience.

You’ll also want to make sure that the payment method offers a clear way for your customers to see:

- The items they want to purchase.

- The items’ costs.

- Exactly where to enter their purchase information.

- How to check out.

It might seem self-evident, but you’d be surprised at how often a payment gateway makes its customers jump through hoops in order to actually make a purchase.

Payment Methods for Your In-Store and Online Customers

Are you currently selling items in person? Do you plan to open a retail location in the future?

If so, you’ll want to get a payment method that plays nicely with your business as a whole. If you don’t, it could end up the squeaky wheel that winds up costing you.

Want your website to support your payment solution? Create them in the same place!

Shopify, Square, and Helcim offer great ecommerce website builders to help you create an online store for free. You’ll be able to use their payment methods for every customer purchase.

Shopify, Stripe, and Square all offer fantastic physical hardware solutions for POS systems.

This is perfect if you have a brick-and-mortar store—or if you run a customer-facing business such as a farmers market stand or a food truck. You’ll even be able to accept multiple forms of payment from your phone.

Best Payment Methods for Ecommerce: Your Top Questions Answered

The Top Payment Methods For Ecommerce in Summary

Every customer has a different payment preference. The best online payment gateways and shopping cart solutions accept multiple payment types to accommodate everyone’s needs.

All of the options recommended in this guide are industry leaders with low fees. While Shopify is the best solution for most, every provider reviewed on our list is worth considering—it all depends on what you’re looking for.